Payment Plans for Off Plan Offices

Discover flexible payment plans for off plan offices in Dubai. Learn about post-handover offices, financing options, and ROI benefits for 2025.

Dubai has become one of the most attractive global destinations for commercial property investment. With its world-class infrastructure, business-friendly environment, and strong investor protection, more businesses and individuals are exploring off plan offices in Dubai.

One of the biggest advantages of buying off plan is the flexibility of payment plans. Developers in Dubai offer structured, easy-to-manage payment schedules that make investing in off plan office projects more accessible than ever. This guide explains the different payment plans for off plan offices, including post-handover options, and why they are beneficial for investors.

Why Payment Plans Matter in Dubai’s Commercial Market

Unlike ready offices, where buyers typically need to pay upfront or secure a mortgage, payment plans for off plan offices allow investors to spread out their financial commitments over several years. This reduces the initial burden and enables businesses to allocate capital more efficiently.

👉 Explore the latest Off Plan Offices in Dubai with flexible payment options.

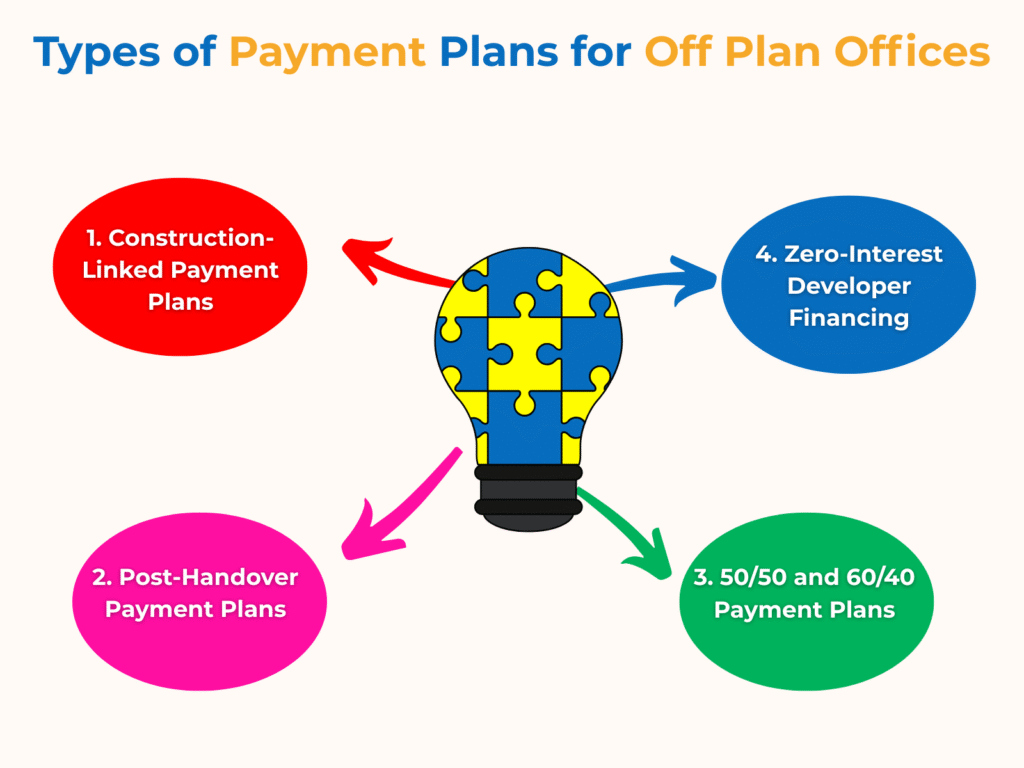

Types of Payment Plans for Off Plan Offices

Payment Plans for Off Plan Offices

1. Construction-Linked Payment Plans

- Payments are tied to specific construction milestones.

- Example: 10% booking, 40% during construction, 50% on completion.

- Advantage: Investors pay as the project progresses, reducing risk.

2. Post-Handover Payment Plans

- Popular in post-handover offices Dubai investments.

- Example: 40% during construction, 60% spread across 2–5 years after handover.

- Advantage: Investors start generating rental income while still paying installments.

3. 50/50 and 60/40 Payment Plans

- Simple models where half is paid during construction and the other half post-handover.

- Best for long-term investors who want balanced cash flow.

4. Zero-Interest Developer Financing

- Some developers offer interest-free installment options.

- Ideal for buyers who want flexibility without extra financing costs.

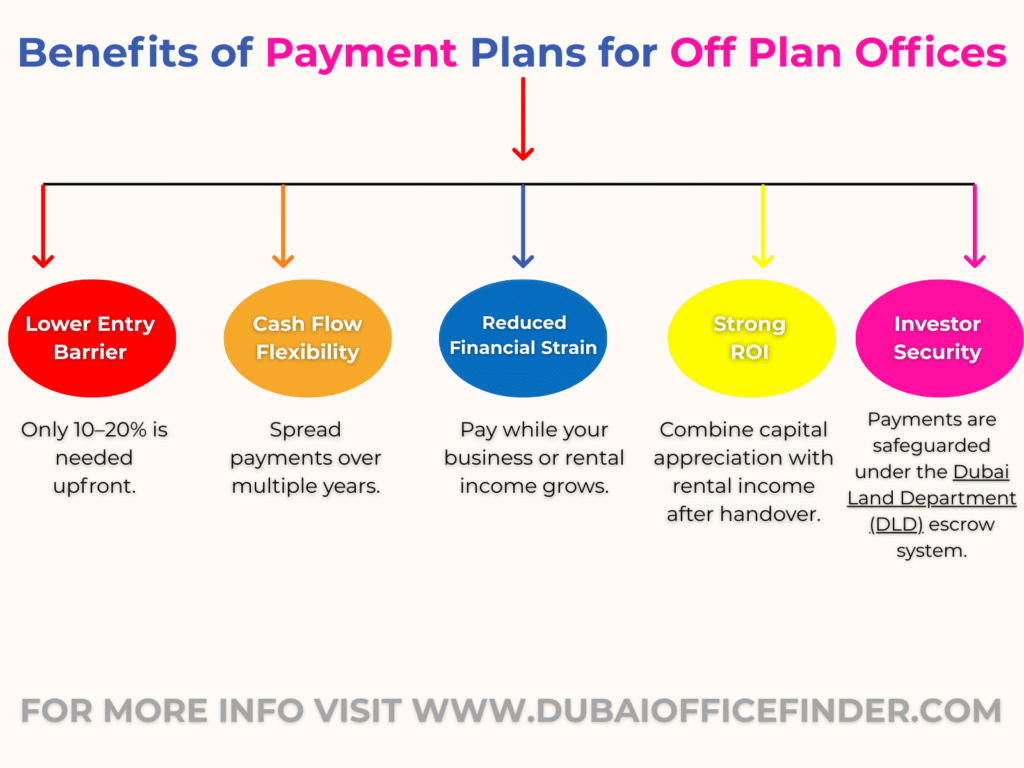

Benefits of Payment Plans for Off Plan Offices

- Lower Entry Barrier – Only 10–20% is needed upfront.

- Cash Flow Flexibility – Spread payments over multiple years.

- Reduced Financial Strain – Pay while your business or rental income grows.

- Strong ROI – Combine capital appreciation with rental income after handover.

- Investor Security – Payments are safeguarded under the Dubai Land Department (DLD) escrow system.

Example of a Post-Handover Payment Plan in Business Bay

Payment Plans for Off Plan Offices

A recent off plan office in Business Bay was launched with the following terms:

- 10% booking amount.

- 40% during construction (linked to milestones).

- 50% over 3 years post-handover.

This means investors could start leasing the office space immediately after completion while continuing to pay the remaining balance in easy installments.

Legal Protection for Payment Plans

The Dubai REST portal (Property Ownership Regulations) ensures transparency for all property transactions, including off plan offices. Investors should always verify the DLD Permit Number to ensure compliance and legitimacy.

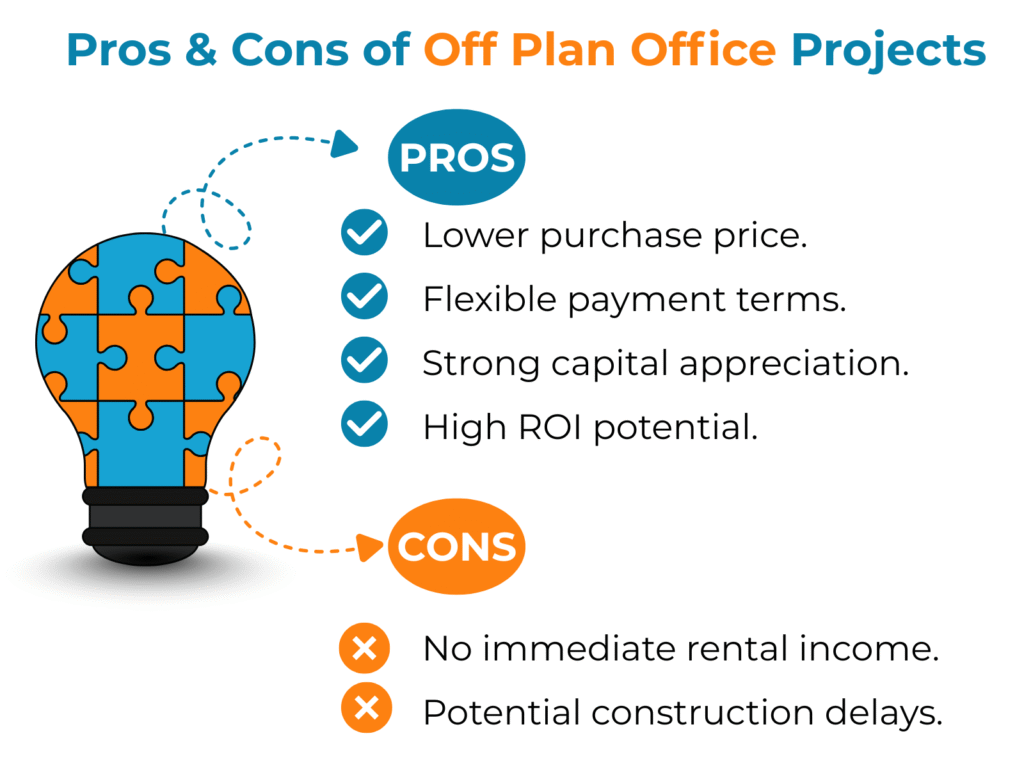

Pros & Cons of Payment Plans for Off Plan Offices

Payment Plans for Off Plan Offices

✅ Pros

- Affordable entry point.

- Easier long-term financial planning.

- Access to premium office locations.

- Potential to earn rental yields during post-handover payments.

❌ Cons

- No immediate rental income until handover.

- Payment obligations continue post-handover.

Mazen Alzoubi – Your Guide to Off Plan Investments

When navigating payment plans for off plan offices in Dubai, expert guidance can make all the difference.

👉 Connect with Mazen Alzoubi on Instagram for exclusive project launches, ROI analysis, and expert advice on structuring the right investment plan.

Mazen specializes in post-handover offices in Dubai and high-ROI opportunities across Business Bay, Downtown, and Dubai South.

FAQs – Payment Plans for Off Plan Offices

Q1: What is the minimum down payment for off plan offices in Dubai?

Usually 10–20% of the property value.

Q2: What is a post-handover payment plan?

It allows investors to pay a portion after project completion, while earning rental income.

Q3: Do banks finance payment plans for off plan offices?

Yes, many banks offer commercial mortgages approved by the DLD.

Q4: Which areas in Dubai offer the best post-handover offices?

Business Bay, Downtown, and Dubai South.

Q5: Are payment plans safe?

Yes, provided they are registered with DLD and follow escrow account protections.

Conclusion

Flexible payment plans for off plan offices in Dubai are transforming the way businesses and investors enter the market. With lower upfront costs, post-handover options, and government-backed transparency, off plan offices offer excellent opportunities for growth and ROI.

👉 Ready to invest? Explore our Off Plan Offices in Dubai page and secure your ideal commercial investment today.